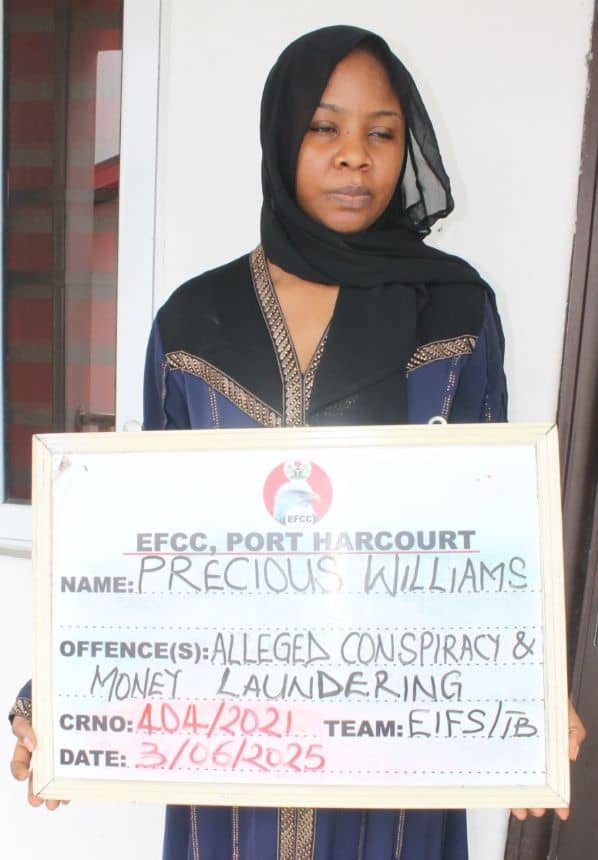

The Port Harcourt Zonal Command of the Economic and Financial Crimes Commission (EFCC) has arraigned Precious Williams, identified as the managing director of Glossolalia Nigeria Ltd and Pelegend Nigeria Ltd, before Justice S.I. Mark of the Federal High Court in Port Harcourt, Rivers State.

Williams faces a 14-count charge involving conspiracy, advance fee fraud, obtaining funds under false pretences, and money laundering, amounting to a total of N13.8 billion.

One of the charges reads: “That you, Precious Williams of Glossolalia Nigeria Limited; Pelegend Nigeria Limited, Phenom 413 Events Limited (company representative at large) and Doxasterz Oil and Gas Limited, sometime between the 24th day of August, 2019 and 15th day of February, 2020, at Port Harcourt, within the jurisdiction of this Honourable Court, directly took possession of the sum of Ten Billion Naira (N10,000,000,000.00) only from Maxwell Chizi Odum (still at large) and MBA Trading and Capital Investment Limited (at large) through your Sterling Bank PLC Account No. 0064260799, when you reasonably ought to have known that the said funds formed part of the proceeds of the unlawful activities, of Maxwell Chizi Odum (still at large) and MBA Trading and Capital Investment Limited (at large) of obtaining money under false pretence from one Christian I. Agadaga and over three thousand (3000) other unsuspecting members of the Nigerian public, under the pretext that it was for investment purposes that will yield for them 10% to 15% interest per month, and you, thereby committed an offence contrary to Section 15 (2)(b) of the Money Laundering (Prohibition) Act, 2011 (as amended) and punishable under Section 15(3) of the same Act.”

READ ALSO: EFCC declares two suspects wanted over N1.3tn CBEX crypto scam

Another charge alleges: “That you, Precious Williams, and Pelegend Nigeria Limited, sometime between the 17th day of December, 2019 and 13th November, 2020, at Port Harcourt, within the jurisdiction of this Honourable Court, directly took possession of the sum of One Billion, Five Million, Nine Hundred and Four Thousand Naira (N1,005,904,000.00) only from MBA Trading and Capital Investment Limited (at large) through Pelegend Nigeria Limited’s Polaris Bank PLC Account No. 0139723989, when you reasonably ought to have known that the said funds formed part of the proceeds of the unlawful activities of Maxwell Chizi Odum (still at large), and MBA Trading and Capital Investment Limited (at large) of obtaining money under false pretence from one Christian I. Agadaga and over three thousand (3000) other unsuspecting members of the Nigerian public, under the pretext that it was for investment purposes that will yield for them 10% to 15% interest per month, and you, thereby committed an offence contrary to Section 15 (2)(b) of the Money Laundering (Prohibition) Act, 2011 (as amended) and punishable under Section 15(3) of the same Act.”

Upon arraignment, Williams entered a “not guilty” plea to all charges. Prosecuting counsel E.K. Bakam then requested the court to fix a date for trial and urged that the defendant be kept in custody.

Defence counsel Tochukwu Maduka, SAN, responded by informing the court of an already filed bail application, pleading for his client to be granted bail in order to prepare adequately for her defence.

However, the prosecution raised an objection, pointing out that the bail application had been submitted prematurely, prior to the amendment of the charge and before the defendant’s arraignment. Consequently, he argued that the defence must submit a new, properly timed bail application.

Justice Mark upheld the objection and directed that the defendant be remanded at the Port Harcourt Correctional Centre. The case was adjourned until June 17, 2025, for the hearing of the bail request.

Williams’ arrest followed numerous complaints lodged by victims who accused her of collecting substantial sums under false pretences and laundering the proceeds.

According to the EFCC, the scheme began between 2019 and 2020 when Williams, in collaboration with MBA Trading and Capital Investments Ltd and others still at large, promoted an investment offer that promised between 10 to 15 percent monthly returns. These offers were reportedly disseminated via social media and other public channels through a network of marketers.

Investors were informed that after an initial six-month investment period, they could either withdraw their capital or roll it over for another term. However, the promised returns were never fulfilled, and neither the capital nor any reinvestment options materialized.

Thousands of Nigerians reportedly fell victim to the scam, resulting in financial losses amounting to billions of naira.